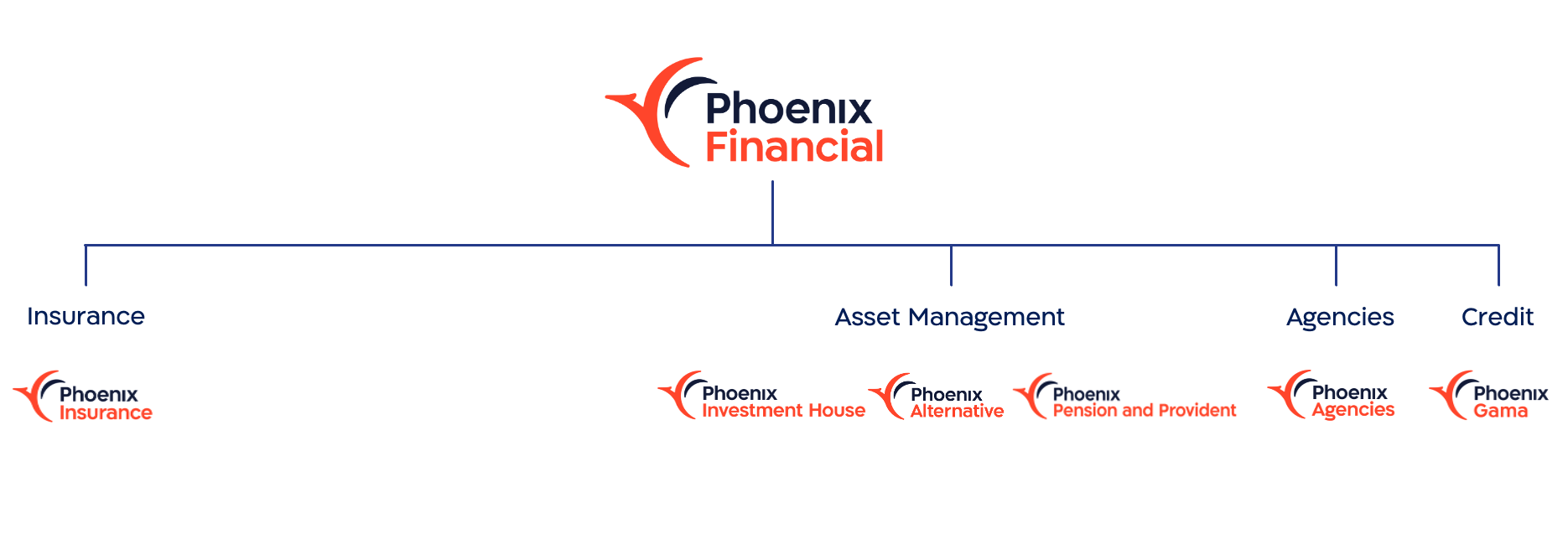

Phoenix Financial, a leading Israeli financial services company with broad Multi-line Insurance and Asset management, Agencies & Credit lines of business.

Phoenix Financial is a leading Israeli financials group listed on the Tel Aviv Stock Exchange.

Phoenix serves a significant portion of Israeli households with a broad set of solutions across businesses and client segments. Managing over $130 billion in assets, Phoenix accesses Israel’s vibrant and innovative economy through a robust investment portfolio, creating value for both clients and shareholders.

The company’s lines of businesses include a broad multi-line Insurance business, including a leading P&C operation as well as significant Life and Health businesses, and a high-growth Asset Management, Agencies and Credit business, with the market leading Investment House, a growing Wealth business, a leading financial distribution footprint, and a growing SME credit platform.

All of our activities generate profitable growth, high returns and steady cashflow, which enables Phoenix to maintain its track record of returning value to shareholder through increasing dividends and share buybacks.

Phoenix Financial seeks to deliver distinctive value to clients and partners with a strong broad-range offering of products and services, diverse and tailored distribution, and a commitment to our customer and agent experience.

We aspire to lead the Israeli financial services industry while creating value to our shareholders.

Phoenix is executing a proven strategy towards defined mid-term targets while constantly assessing market trends and benchmarks for opportunities and potential risks.

The Phoenix provides updates on its strategic execution and progress towards its key financial targets every quarter.

As a leading institutional investor, the size, reputation, and capabilities of the Phoenix create unique access to Israel’s growing, vibrant, and innovative economy. Our market position enables us to identify and create opportunities for value creation for Phoenix’s clients and shareholders.

The Phoenix’s investment team has deep expertise across Israeli equity, fixed income, infrastructure, real estate, and alternative investments. In addition, the Phoenix has a significant and growing focus on international investments and partners with best-in-class asset managers globally.

The Phoenix invests in innovative technologies across various sectors, including but not limited to software and hardware, services, energy, agriculture, financial services, both directly and through venture capital funds.